The New Gardner Report!

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

Your New Property Tax Valuation…..WOW!

If you own a home in Larimer County, you are probably excited about the increase in equity over the last few years due to the appreciation level we have seen. If you are buying a home in Larimer County right now, don’t worry you aren’t left out in the cold, the prognosis for property values in the next 5 years is still good! But there is one fly in the ointment when it comes to appreciation, and those are your property taxes. The county assessor is re-assessing values, and most of these are going to be going up. The way that the Assessor looks at values is interesting, and if you would like help trying to fight your tax value and getting it lower, I can pull the specific information that is required to do that, and show you the steps. Give me a call or shoot me an email if you are interested and we can talk more about the details!

Friday Fun Facts – Mortgage Rates

|

|

Friday Fun Facts

|

|

Friday Fun Facts!

The Next Boulder?

The hottest question we get in Northern Colorado is this “do you think Fort Collins is the next Boulder?”

Let’s look closely at that question and start with what is similar. They are both college towns nestled against the foothills. They both have affordability issues which push real estate buyers to satellite communities (what is happenning is Wellington is not unlike what happened in Louisville).

Yet there are differences at a fundamental level that will forever keep these two places very different from each other (which is great for us Fort Collins-ites who love the culture here!). For example the average Household Income in Boulder is 60% higher than Fort Collins. Here is another big deal, Boulder is only half the size of Fort Collins (25 square miles versus 57 square miles). And get this, the City of Boulder owns 71 square miles of open space in and around the City.

Essentially Boulder is a small island surrounded by an ocean of open space inhabited by very high income-earners. That is why the average price of a single family home in Boulder is now over $1 million.

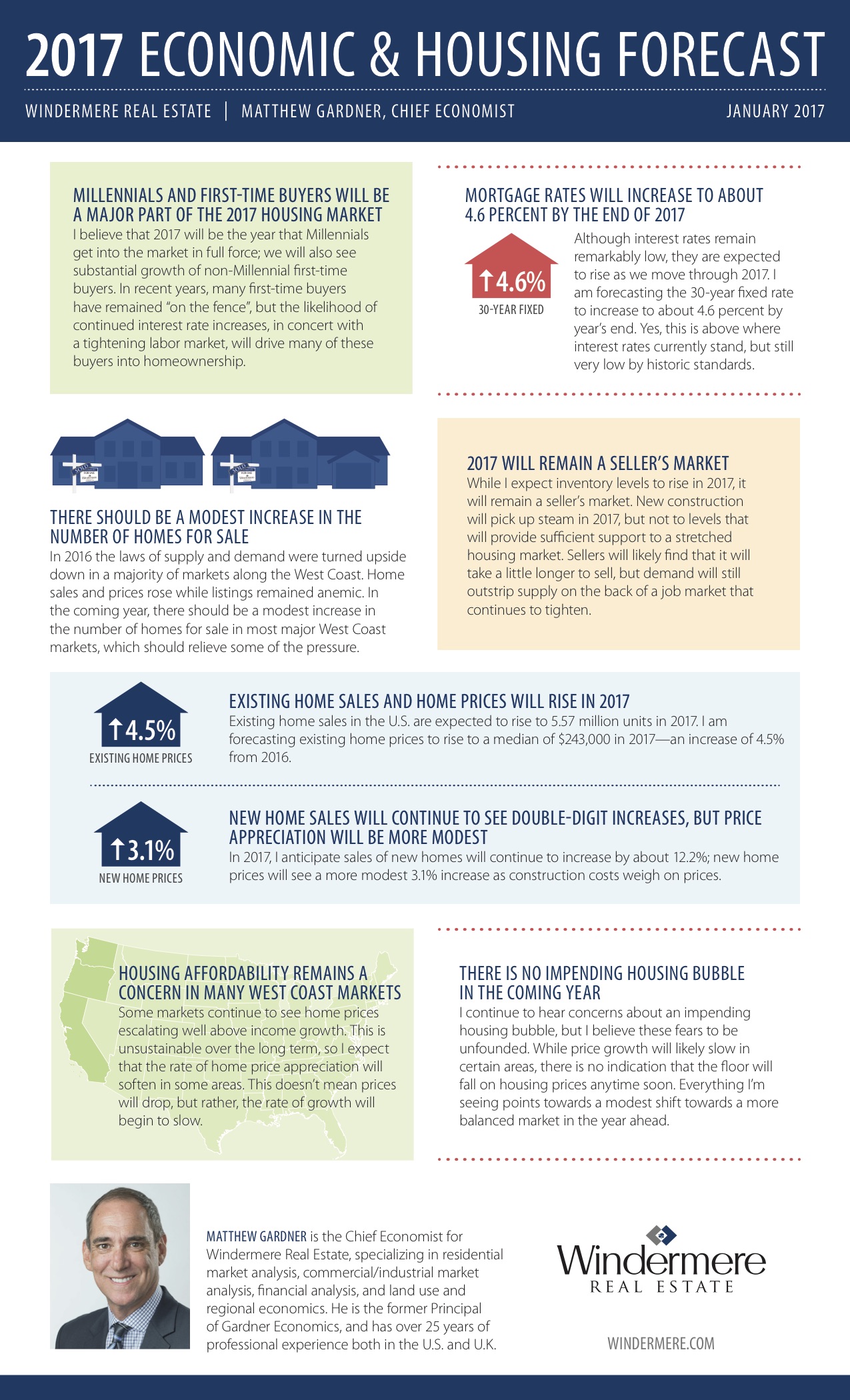

2017 Real Estate Market-Where Are We Going?

What’s Happening In The 2017 Real Estate Market?

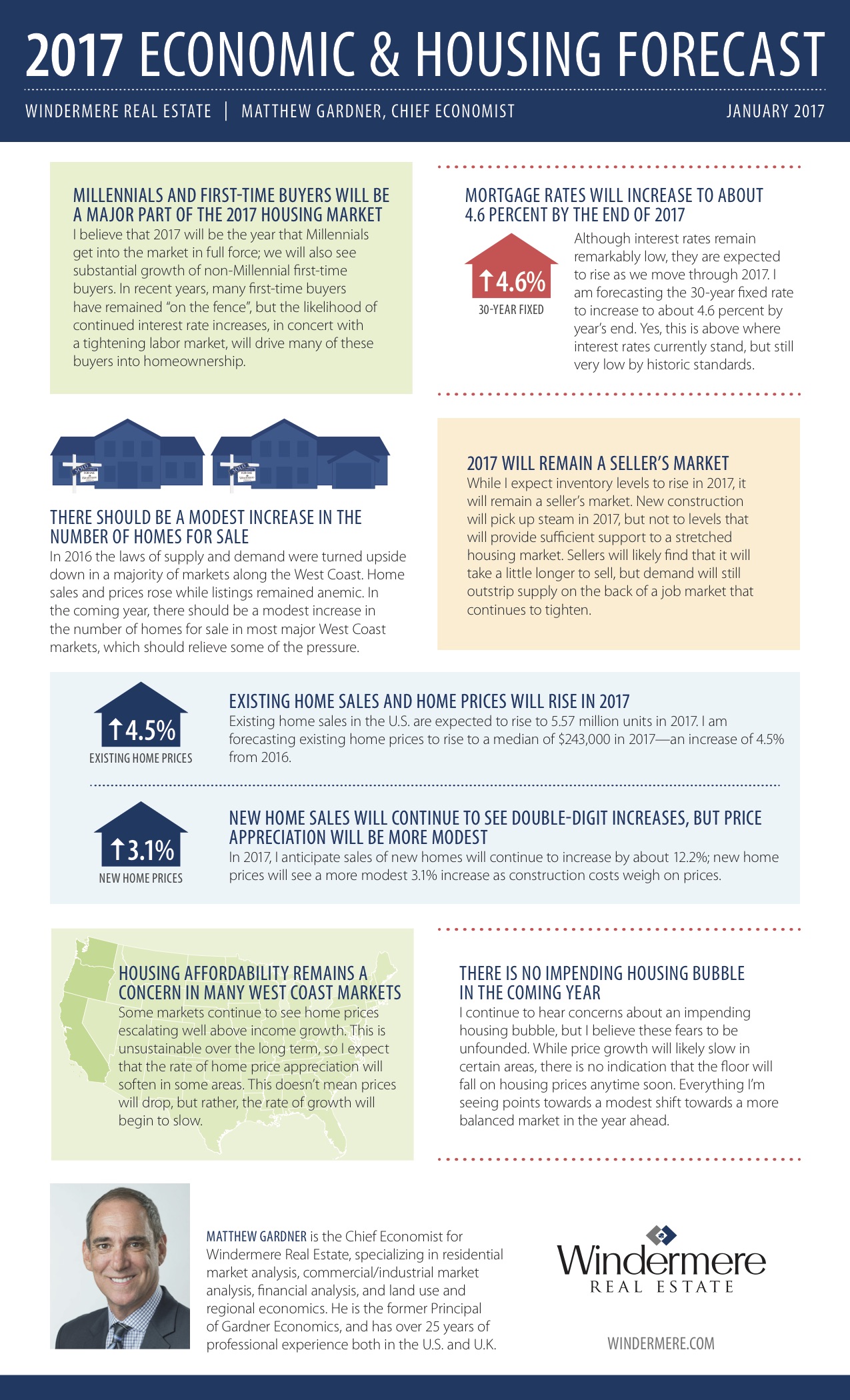

I want to thank everyone who came out to the Windermere Forecast last week, it was great to see so many people there interested in the real estate market and where we are headed in the future. I wanted to make sure that even if you did not make it, you are familiar with some of the big takeaways from the presentation.

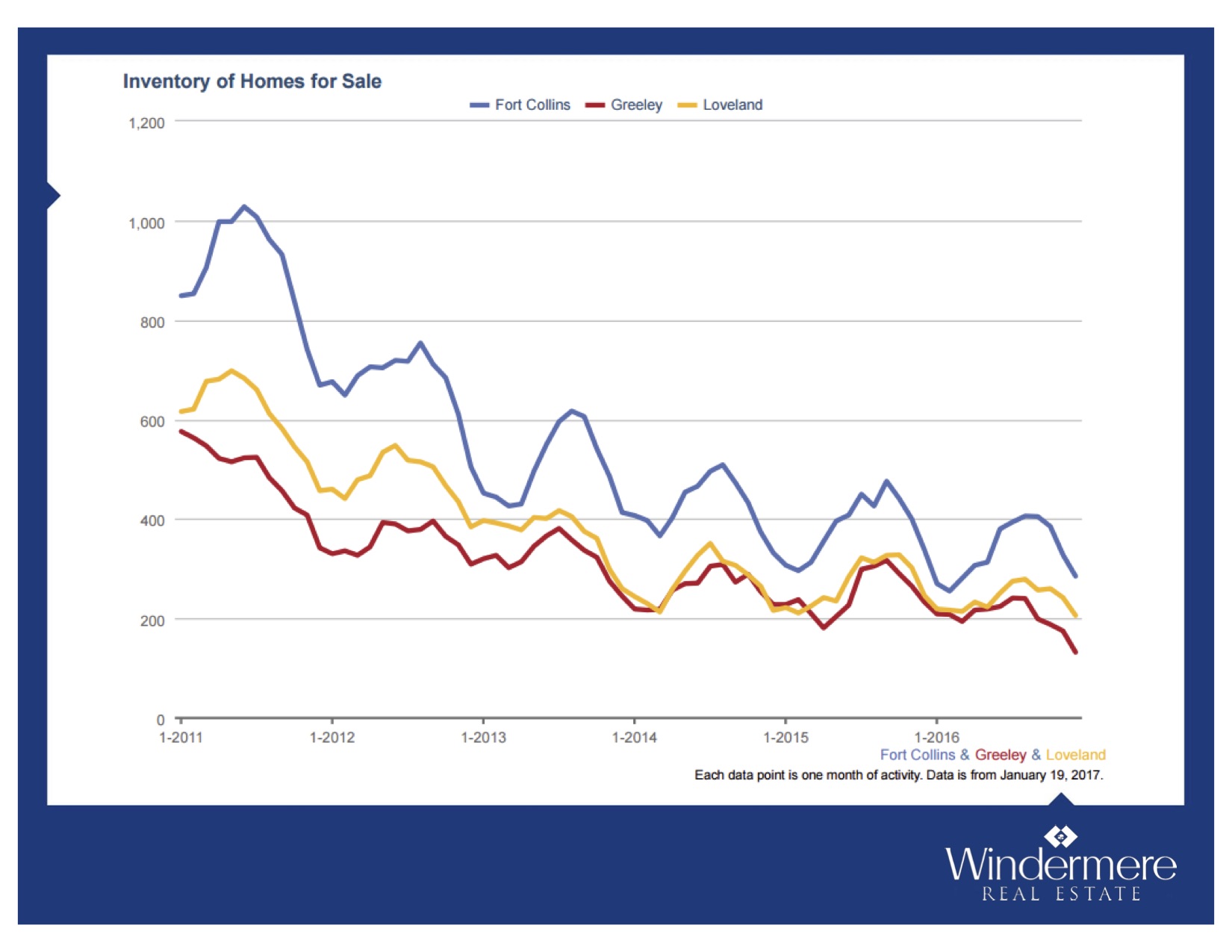

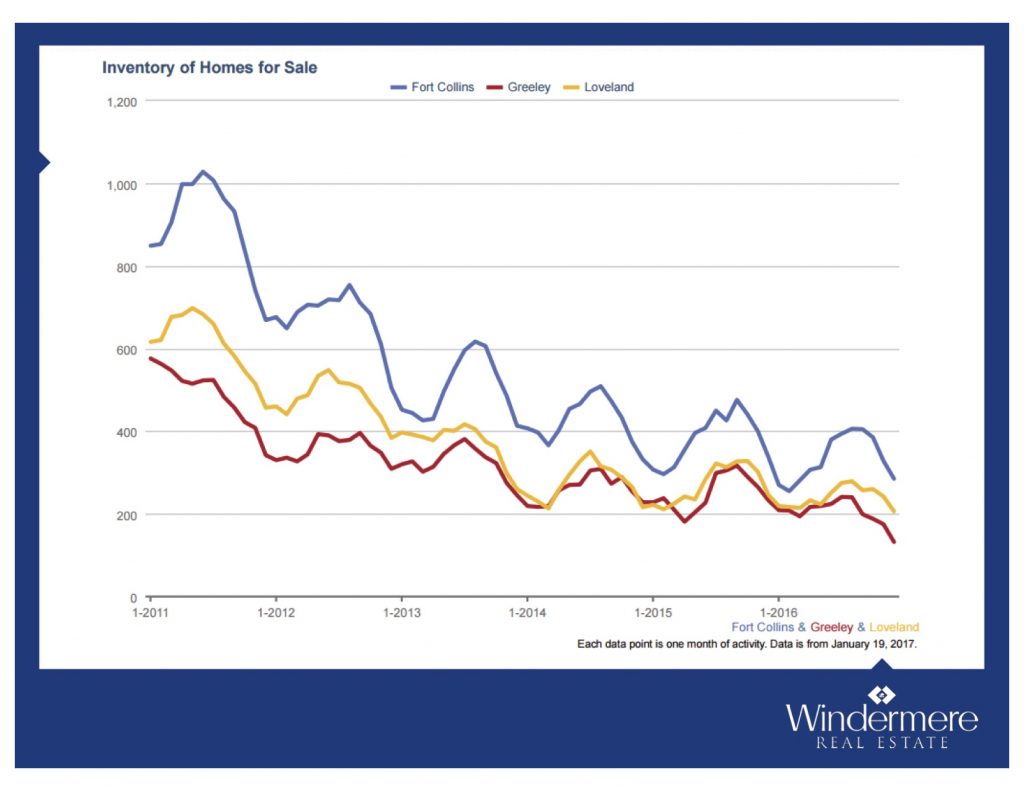

The big story of course is the ongoing low inventory in Northern Colorado. We are at a quarter of where we were back just 6 years ago in 2011, just check out the graph below. This will continue to drive a fast moving market through 2017, although potentially not at the same pace we saw in 2016. That cooling off will be a product of increasing interest rates as the year progresses. While it is certainly great to be a seller in this market, there are still great ways for buyers to get more home than they could have afforded in the past because of where interest rates are currently.

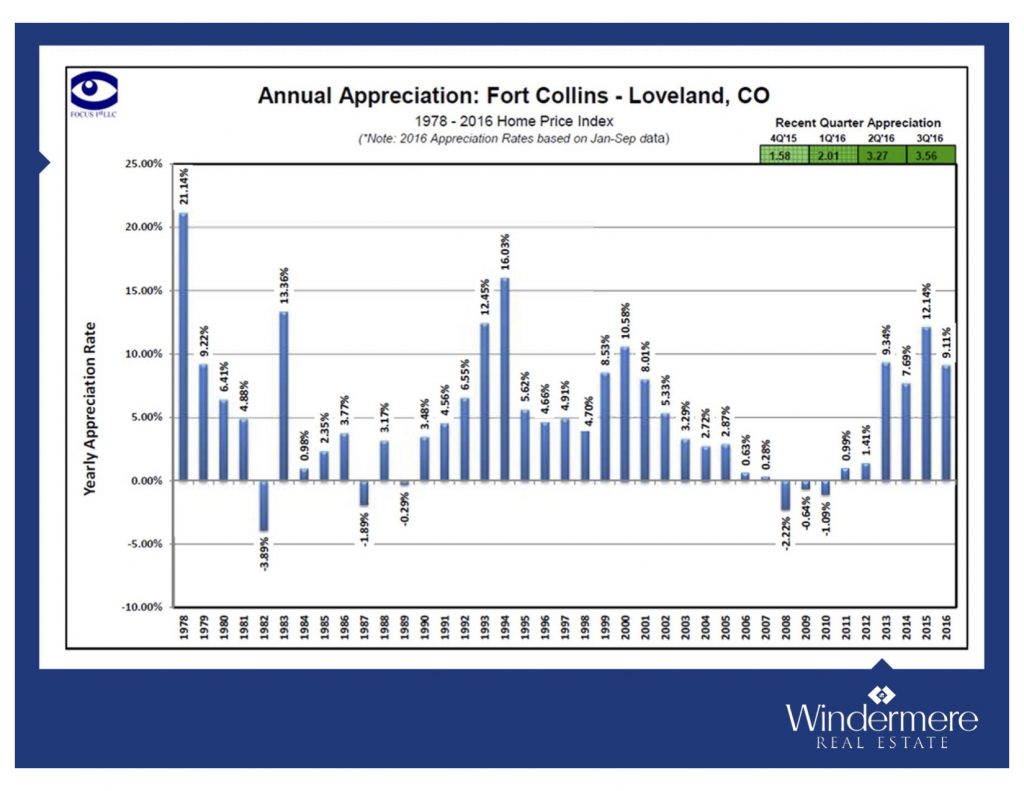

What that low inventory has driven is an above average appreciation rate for the Fort Collins/Loveland areas (as well as the rest of Northern Colorado). As you can see below, we are above the long term 5% appreciation average, so again that will probably slow down just a little bit in to 2017, although we will still be appreciating!

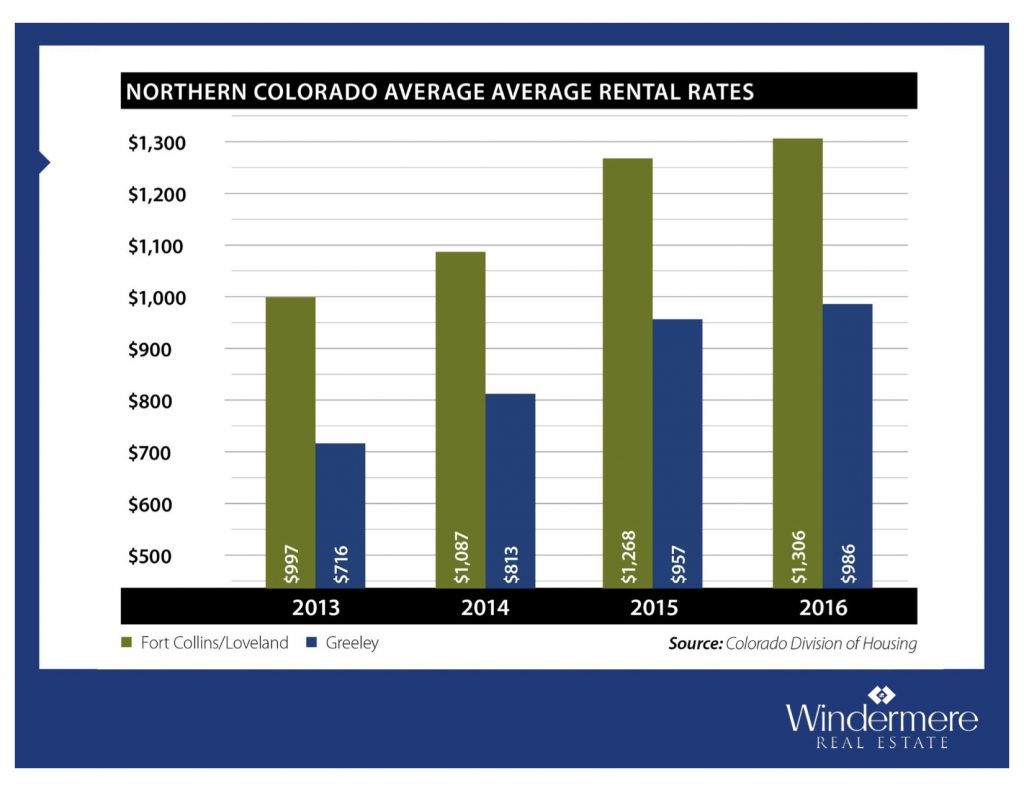

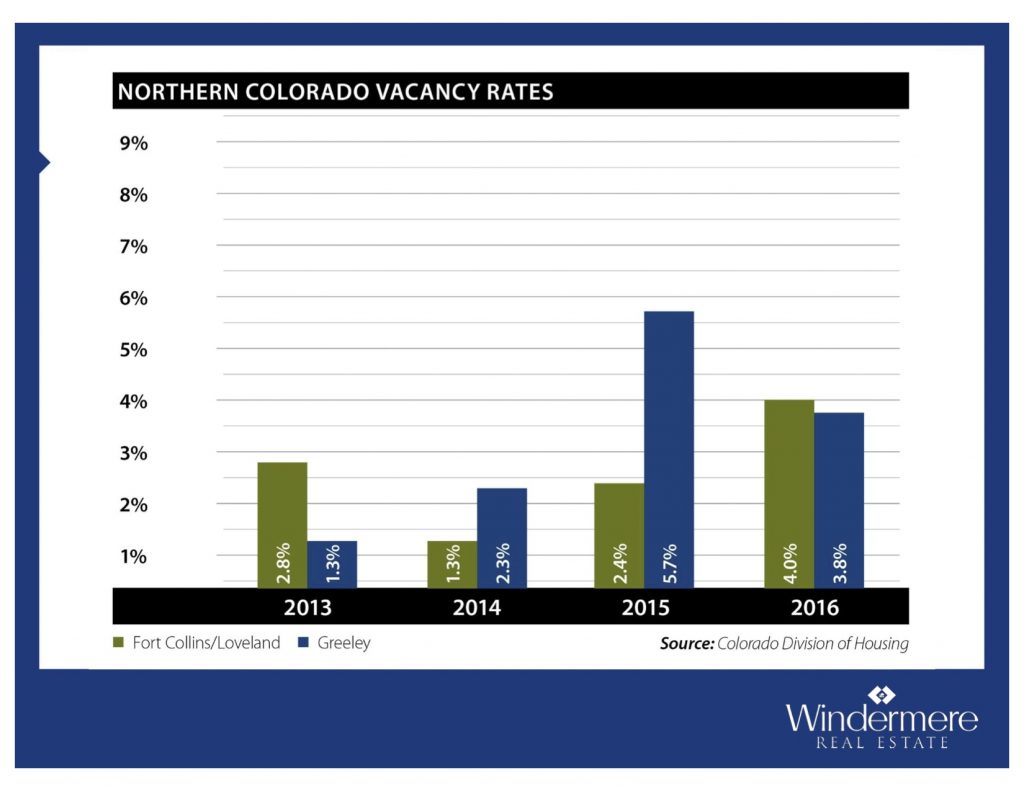

One of the other big questions I get is from my investors, and that is “why should I buy an investment property with these increased prices?”. The answer lies in two things. The first is low interest rates, and the second is with massively increased rents. Even when a 3 bedroom 2 bath home near the CSU campus was $100,000 less than it was today, we are STILL cash flowing about 60% more than we were back when prices were lower. As you can see below, we have seen an increase in rents, along with a decrease in vacancy (especially if you look at a longer 10 year term).

If you have any questions about this info, or want to talk more about buying, selling, or investing in real estate, I’d love to take you to coffee to discuss it!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link