Townhomes Are Back!

With the change in construction defects laws in Colorado in 2017, we are seeing condos and townhomes coming back in force! This is great news for first time homebuyers that start with an attached home before they move on to bigger, better, and more expensive things. Here are some interesting stats that show what is going on with the townhome market…

- Townhome and duplex growth is up 36 PERCENT for the year

- This market segment represents 26 PERCENT of the total market

- This is the HIGHEST percentage the townhome and condo market has ever been

- Detached single family homes represent only 70 PERCENT of the new home starts, the lowest since 2009

This info and more is found in my monthly Windermere Report Newsletter. If you would like to sign up to receive this info from me just shoot me an email. Have a great week!

2018 Market Forecast

Happy 2018, I hope the year is starting off wonderfully for you! As we start the year, you might be wondering, “what is going to happen in the Northern Colorado real estate market this year?” The good news is, we have an answer! We will be hosting our Annual Windermere Real Estate Market Forecast again this year, on January 18th at 5:30pm at the Marriott in Fort Collins. If you would like to attend, check out the website at www.WindermereForecast.com.

In the meantime, check out what the Windermere Economist, Matthew Gardner (who will be speaking at our Forecast event), has to say about the national market and economies below. I look forward to a fantastic year with you!

Friday Fun Facts!

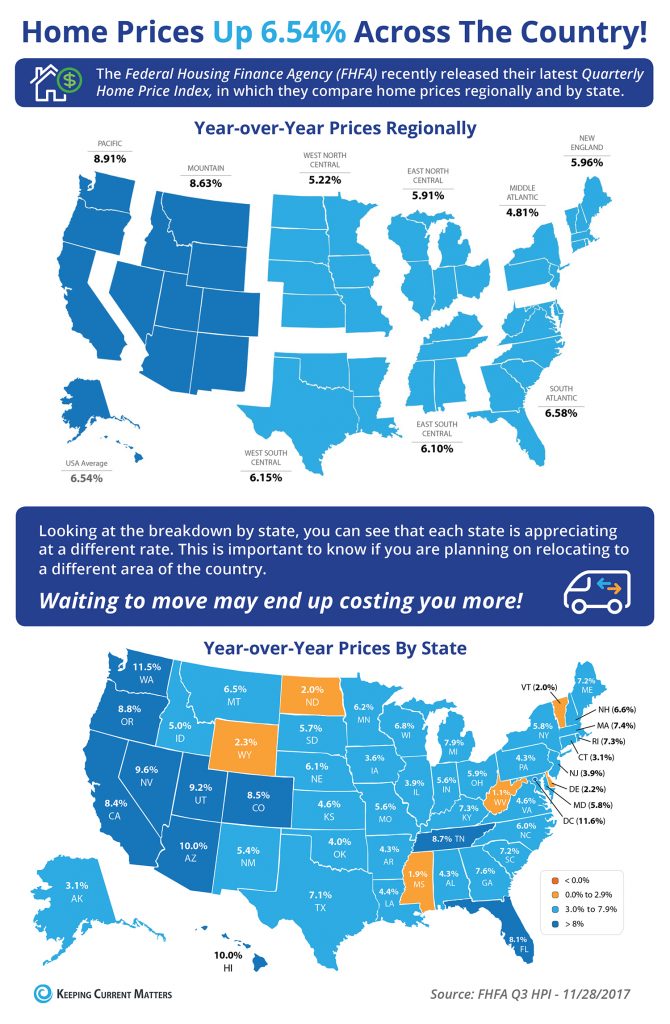

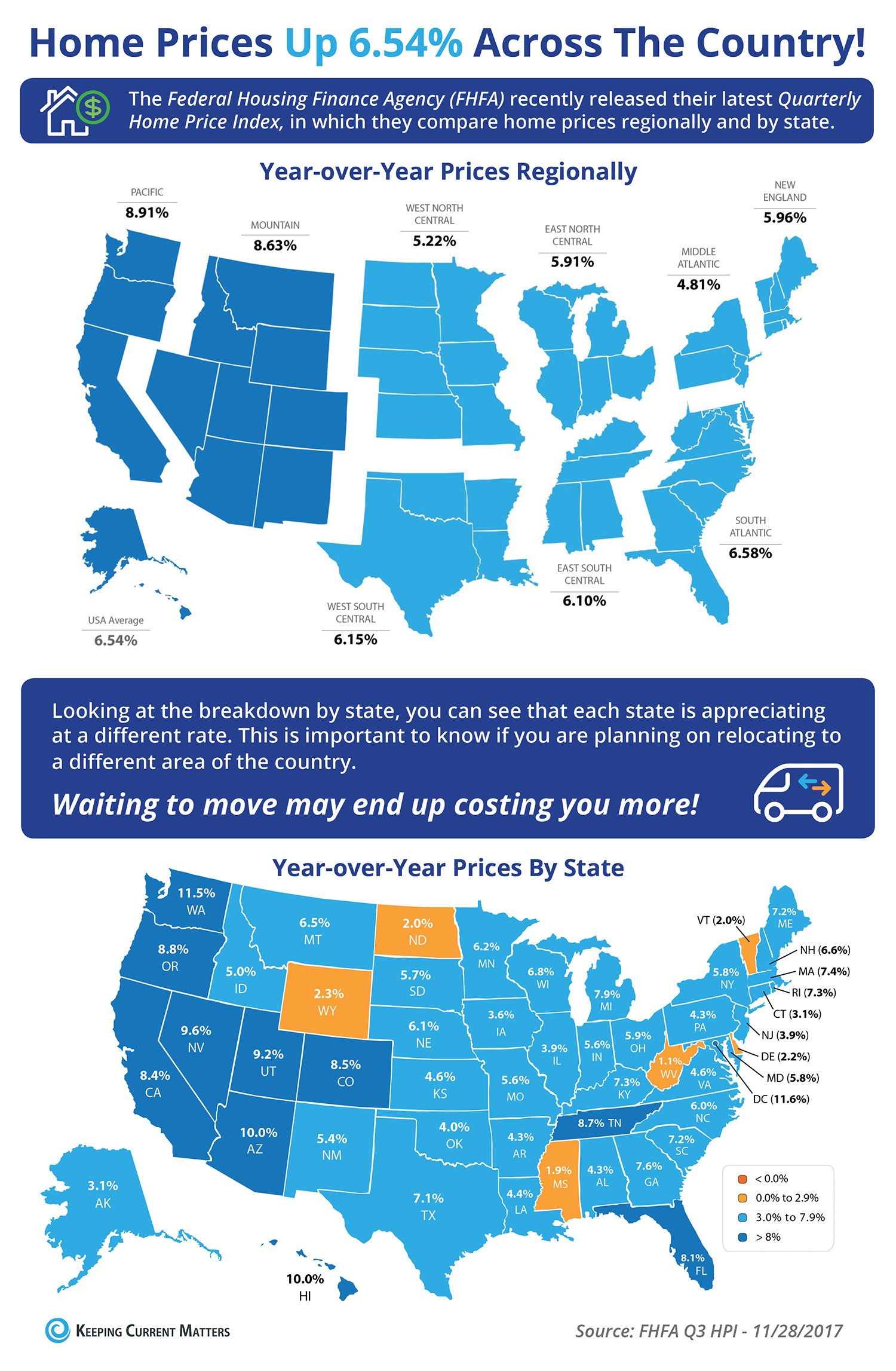

Home Price Increases – What Will It Cost?

Check out the picture below to see how home prices are increasing by region, this comes from www.keepingcurrentmatters.com and the direct link is HERE. Let me know what you think!

Friday Fun Facts!

|

|

Get Real

A story ran last week which highlighted the number of people who have moved out of Colorado.

Let’s get real, there are still a large number of people moving to Colorado.

In fact, 223,000 moved to Colorado from another state last year according to the latest American Community Survey from the U.S. Census Bureau.

The net migration into our state (after subtracting out people who left) was 30,859 people.

In Northern Colorado the net migration looks like this:

- Larimer County = 7,001 people

- Weld County = 7,117 people

So what does that mean for housing? Knowing that, on average, 2.5 people live in each household, the number of new housing units required for these new residents looks like this:

- Larimer County = 2,800 new housing units

- Weld County = 2,847 new housing units

Any questions about this information, give me a call!

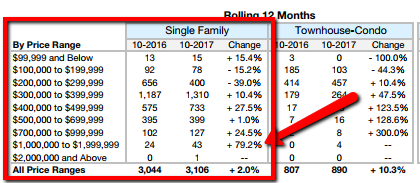

Luxury Leaps

Friday Fun Facts – Long vs Short

|

|

Friday Fun Facts!

|

|

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link