Friday Fun Facts!

|

|

Northern Colorado – Big Stuff Happening!

I get a lot of questions about what is happening in the Northern Colorado Real Estate market, and while I address the residential side of things regularly, the commercial market has been driven by our great economy and way of life in the area. Here are just a few recent sales that show the strength of real estate in our area…

- A Denver based company purchased The Buttes Apartments in Loveland for $16.19 million. The property was 98.8 percent leased at the time of sale.

- A company in Austin bought the State on Campus apartments on Stuart in Fort Collins for $71.08 million, it was a total of 220 units.

- The owner of the Fort Collins Club purchased the old Orchards Athletic club in Loveland for $800,000, and will be renovating it over the next year to bring a high end gym to the Loveland area.

- A local buyer bought the Holiday Inn Express in Greeley for $5 million, it has 64 rooms and is located on W 29th St.

With the development near Highway 34 and I25, we will see continued commercial growth in the area, so stay tuned for more updates!

Friday Fun Facts! Fall vs Spring And Listing Your Home

|

|

The Latest Gardner Report!

Check out the latest Gardner Report below with information and stats on the Northern Colorado Real Estate Market!

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

Student Housing Is Not Finished Yet!

Although it seems like they have been building new apartments for students for years now in Fort Collins (they have), we won’t be seeing a slowdown of that quite yet. There are several large developments in the works right now that won’t see completion until the end of 2018 and beyond.

Brinkman is breaking ground on a $16 million project called Copper Leaf Place on Shields and Horsetooth soon, with apartments being ready for rent between mid May and Late June of 2018. The over 80 units will range in rent from $1,000 to $1,625 per month.

Another big development on the horizon was the purchase of the St Paul’s Episcopal Church on W Elizabeth Street just west of the CSU Campus. A company that already owns three other student housing developments bought it for $4.18 million, and will start development on the property sometime in 2018.

With high rents and the stable Fort Collins economy, large companies and real estate developers are still feeling great about the area. Which is great for housing values, jobs, and Fort Collins in general. If you have any questions on this information or the real estate market in general, please feel free to give me a call!

Update On Market Absorption (Amount of Inventory)

Here we are halfway through the summer already! Time flies when you are having fun I guess!

I want to get you the update on the quarterly real estate market absorption rate that I analyze each quarter for Fort Collins. As a reminder, inventory or Absorption Rate is the amount of time it would take to sell all of the homes on the market today, if no more homes were to be listed. We have been hovering around 1.1 months to 1.3 months for over a year now (SUPER low inventory, a balanced market is 6 months of inventory according the National Association of REALTORS). But we are seeing a slight uptick to 1.58 months at the beginning of July. While that is still very low and certainly a seller’s market, we are seeing more homes hit the market and sit around for a week or two, which is providing great opportunities for the buyers I have been working with. It is a slightly less daunting market than it was in March.

If you are interested in learning more about how this could be an opportunity for you as a Buyer in the Northern Colorado area, please feel free to give me a call or shoot me an email! Enjoy your week!

Northern Colorado A Great Place To Invest! (We already knew that!)

Yet again, Fort Collins and Northern Colorado are being recognized as being great places to invest in Real Estate. The map below has some very interesting information about the whole country, but zoom in on Northern Colorado and check out all of the good news, it’s good to be us!

Give me a call or shoot me an email if you have any questions, thanks!

July Edition of The Scoop!

Where Is The Market Right Now?

As we hit the middle of the year, it is good to look not only back at where the market has been, but forward to where the market is going. There are several interesting factors at the moment that make this a slightly different market than it was 5 months ago, but the big things to keep an eye on for both Buyers and Sellers are:

- Interest Rates

- Housing Starts (new construction)

- Days on Market

- Inventory

Interest Rates remain low for the time being, and this is an opportunity for both Buyers and Sellers. Low interest rates make payments more affordable for Buyers, but also make it so that Buyers qualify for more home for their buck making it easier for Sellers to realize higher sales prices. As we start to see interest rates increase towards the end of this year and heading in to next year, this opportunity will slow down for EVERYONE in the market.

Housing Starts are actually down in Colorado right now (even thought it seems new construction is everywhere!), which means we most likely will continue to see a shortage of new homes, driving more Buyers to the resale market keeping that inventory tight. As construction defects legislation allows builders to build condos and townhomes though, hopefully we will see more of those start to come down the pipeline. We’ll keep an eye on that for you.

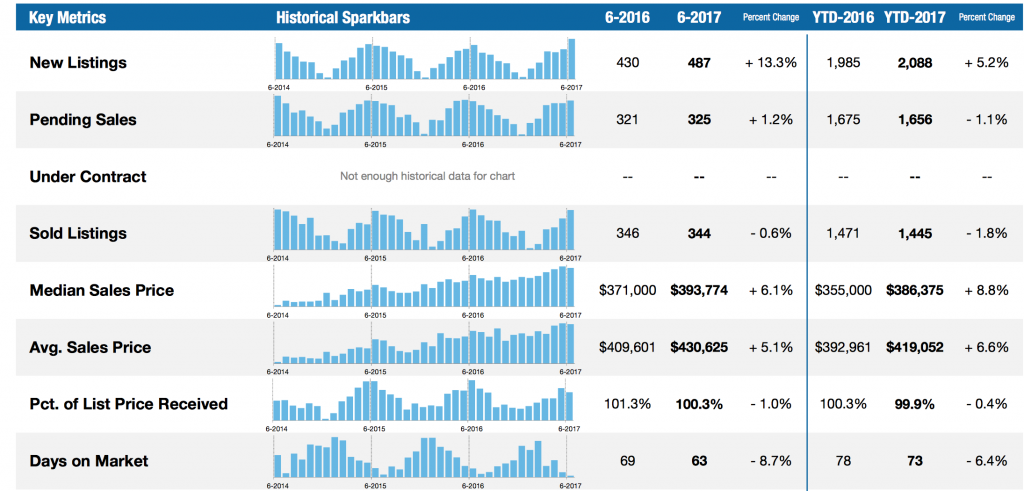

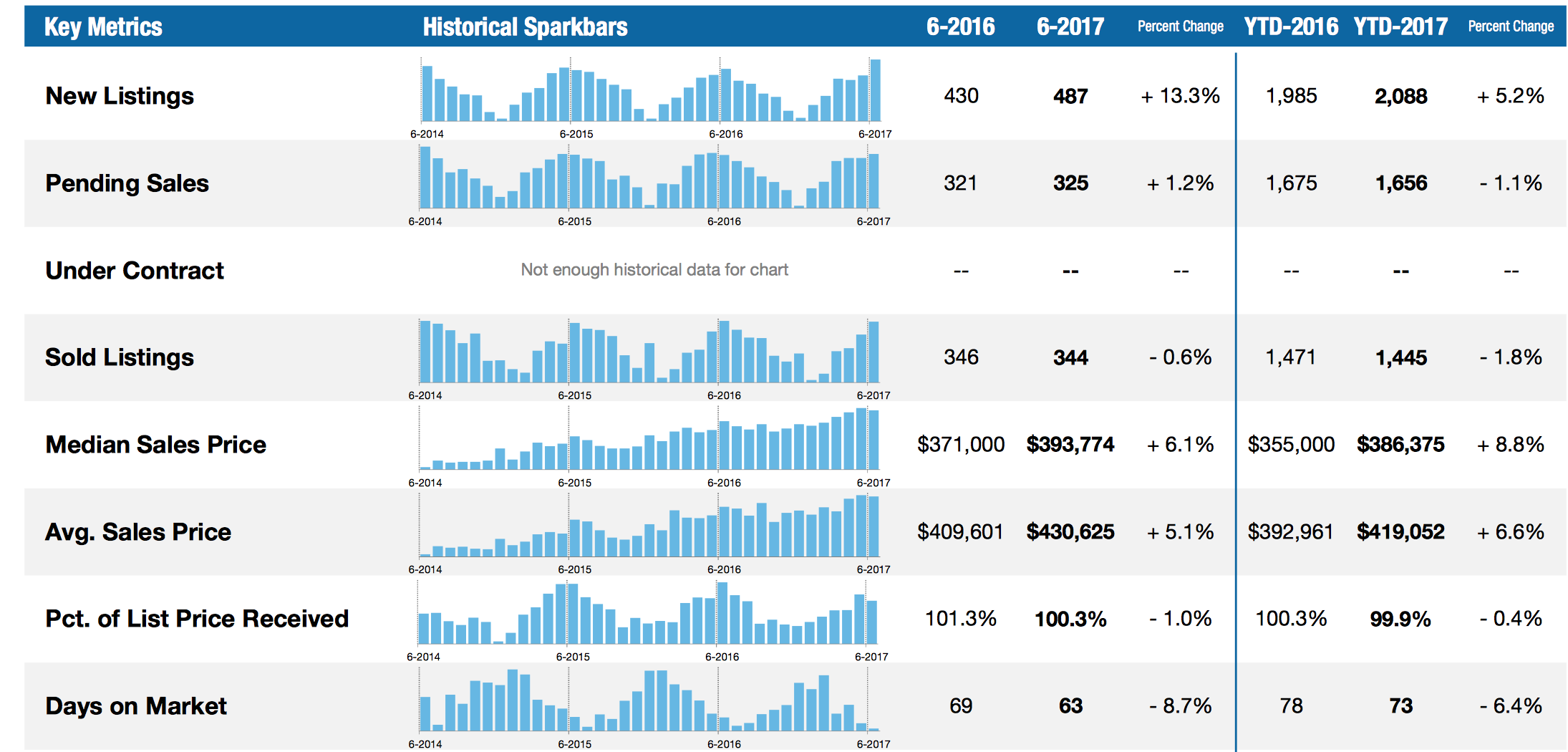

As you can see below (information from the Fort Collins Board of REALTORS), for the Fort Collins area Days on Market has decreased by 8.7% for single family homes, indicating Buyers are still out there wanting homes!

You can also see that we are seeing increasing inventory though, but 13.3% which means there is a little bit more for Buyers to look at, good news to those who have been making offers and losing out.

So opportunities exist for both Buyers and Sellers in this market, and there are pockets that have more strength for one party or another. If you are interested in learning more about the market you may be interested in buying in or have a home to sell and want to see what that looks like for your particular area, please give me a call or shoot me an email. Thank You!

Fort Collins – As Stable As It Gets!

We have been saying it for years, and so have the experts! Real Estate in Fort Collins is a stable investment that does not suffer from a bubble environment (think Vegas and Miami). The combination of a stable employment base (high tech, Colorado State University, service industry and the HUGE beer industry), increasing population growth, and limited new home building opportunities all lead us to a great place to invest in real estate. Whether it is for your own home or rental properties, we have seen a steady increase in rents and in values over the last 10 years. Check out the link to the Realtor.com article below that talks about how Fort Collins is the #1 stable market in the country!

Realtor.com Article On Fort Collins

If you have any questions about real estate or investing in our Northern Colorado market, please give me a call or shoot me an email. I look forward to hearing from you!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link