Another Meltdown?

This week our Chief Economist took a deep dive into the numbers to examine the current health crisis versus the housing crisis of 2008.

The reason why? People wonder if we are going to have another housing meltdown nationally and going to see foreclosures and short sales dramatically increase.

It turns out that the numbers show that today’s housing environment is quite different than 2007, right before the housing bubble burst.

Specifically, homeowners are in a vastly different situation with their mortgage compared to the pre-Great Recession’s housing meltdown.

In addition to much higher credit scores and much higher amounts of equity compared to 2007, the most significant difference today is in the amount of ARM mortgages.

Back in years leading up to the housing bubble, Adjustable Rate Mortgages were very prevalent. In 2007 there were just under 13 million active adjustable rate loans, today there are just over 3 million.

The number of those ARMs that would reset within three years was 5 million in 2007 compared to only 320,000 today.

It’s those Adjustable Rate loans resetting to a higher monthly payment that caused such a big part of the housing crisis back in 2008 to 2010.

Back then not only was people’s employment impacted, but many were facing increased monthly mortgage payments.

That’s why there were so many foreclosures and short sales in 2008 to 2010.

That is not the case today and one of many reasons why we don’t foresee a housing meltdown.

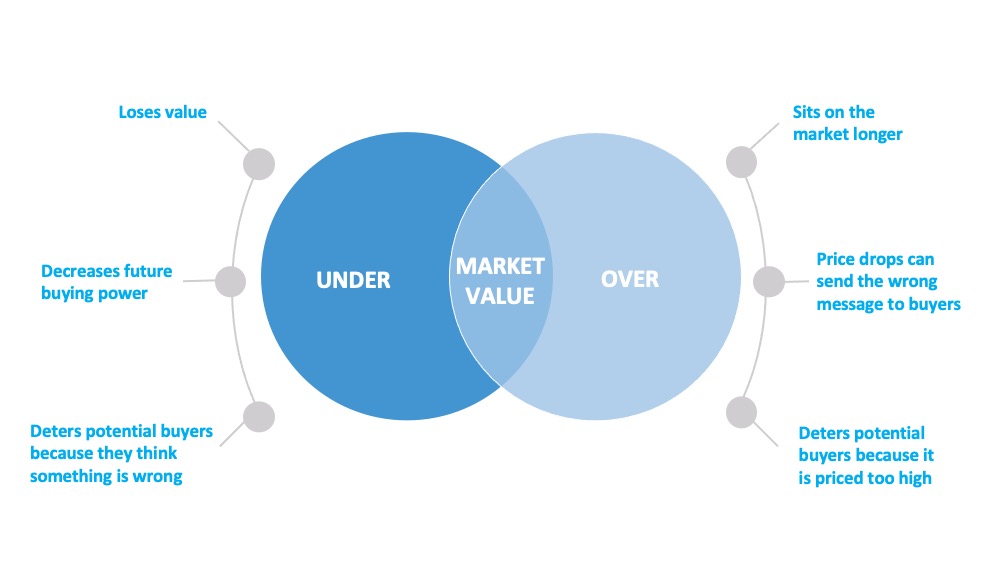

Supply and Demand

Northern Colorado gave us a real-life economics lesson in January 2020.

Compared to one year ago…

- Inventory was down 10% (Supply)

- Homes under contract went up 31% (Demand)

- Prices were up 5% (Result)

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link