How’s 2019?

|

|

New Downtown Loveland Hotel

There has been A LOT of development in the Loveland and Fort Collins areas in the way of accommodations in the last few years. The Elizabeth Hotel in Fort Collins being one of the most notable. But Loveland is keeping up with its Foundry development that is a public/private partnership to bring even more life to the Downtown Loveland area.

A new hotel is being added to the mix, and it will be a 102 room Towne Place Suites by Marriott, and it will be right downtown. There will be an indoor swimming pool, meeting space, and will be pet friendly. Now people will be able to look at Downtown Loveland as a destination, with shopping, restaurants and hotels all within walking distance of each other.

If you have any questions about this hotel or the Foundry development in Loveland, give me a call!

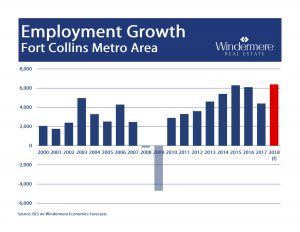

Windermere Market Forecast

I want to thank everyone that was able to make it to our Market Forecast last week, we all really appreciate it! If you would like to get the powerpoint presentation or would like a rundown from the event, please give me a call or shoot me an email. Or if you would like to know more about the market activity in your neighborhood or the value of your home specifically, let me buy you lunch and we can talk more about it!

Friday Fun Facts

|

|

The New Gardner Report!

|

|||||||||||||||||||

|

|||||||||||||||||||

|

|||||||||||||||||||

|

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link