14 Times

For the 14th time this year, 30-year mortgage rates set a record and hit an all-time low.

Based on data just released by Freddie Mac, rates are now at 2.71%. Their weekly survey of the 30-year mortgage rate dates back to 1971.

Just one year ago rates were at 3.68%.

So, what does this mean for buyers?

Based on a $400,000 loan, current rates result in a monthly payment that would be $212 less than one year ago.

At Windermere Real Estate we are taking Safer at Home and Social Distancing very seriously. Our people are following our Safe Showings protocol, staying connected to their clients, and providing help wherever needed.

Rate Meaning

Mortgage interest rates have hit another record low this week.

Mortgage applications for purchases just hit an 11-year high.

Rates are at a level that many people could never have imagined.

Here’s something that is surprising to many people…

Rates are 1.5% lower than they were just two years ago.

Here’s what that means for buyers…

Pretend someone is looking at a $500,000 home and they will have a 20% down payment.

The difference in monthly payment is $320 between two years ago and today.

Obviously that is a significant amount of money.

Imagine what a person could do with $320 per month.

The fact that rates are at record lows is one of many reasons that the market is so strong right now and prices continue to appreciate at healthy levels.

2019 Economic and Housing Forecast Preview

|

|

|

|

|

|

|

Friday Fun Facts!

|

|

Where Is The Market Right Now?

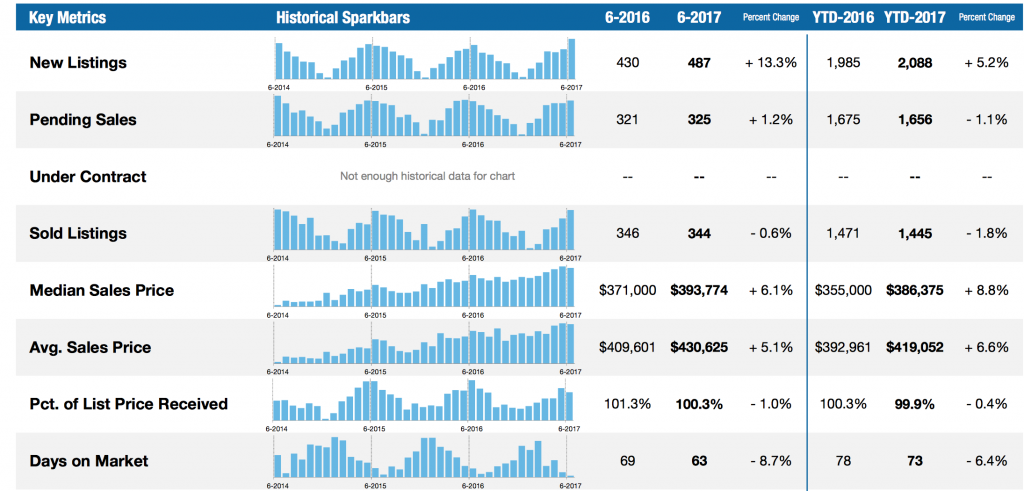

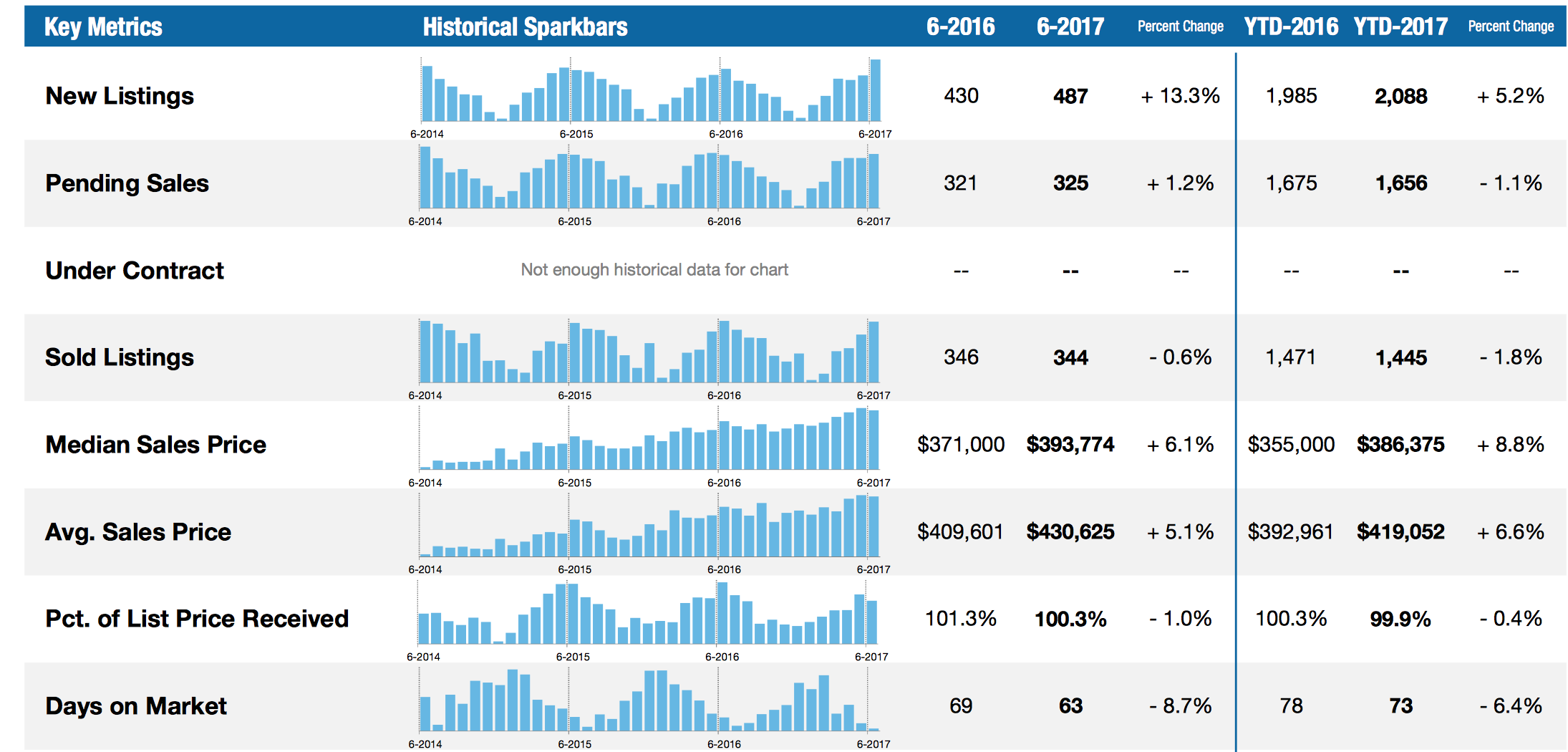

As we hit the middle of the year, it is good to look not only back at where the market has been, but forward to where the market is going. There are several interesting factors at the moment that make this a slightly different market than it was 5 months ago, but the big things to keep an eye on for both Buyers and Sellers are:

- Interest Rates

- Housing Starts (new construction)

- Days on Market

- Inventory

Interest Rates remain low for the time being, and this is an opportunity for both Buyers and Sellers. Low interest rates make payments more affordable for Buyers, but also make it so that Buyers qualify for more home for their buck making it easier for Sellers to realize higher sales prices. As we start to see interest rates increase towards the end of this year and heading in to next year, this opportunity will slow down for EVERYONE in the market.

Housing Starts are actually down in Colorado right now (even thought it seems new construction is everywhere!), which means we most likely will continue to see a shortage of new homes, driving more Buyers to the resale market keeping that inventory tight. As construction defects legislation allows builders to build condos and townhomes though, hopefully we will see more of those start to come down the pipeline. We’ll keep an eye on that for you.

As you can see below (information from the Fort Collins Board of REALTORS), for the Fort Collins area Days on Market has decreased by 8.7% for single family homes, indicating Buyers are still out there wanting homes!

You can also see that we are seeing increasing inventory though, but 13.3% which means there is a little bit more for Buyers to look at, good news to those who have been making offers and losing out.

So opportunities exist for both Buyers and Sellers in this market, and there are pockets that have more strength for one party or another. If you are interested in learning more about the market you may be interested in buying in or have a home to sell and want to see what that looks like for your particular area, please give me a call or shoot me an email. Thank You!

Do You Think Interest Rates Will Go Up?

Happy Monday morning everyone! What are your thoughts on where interest rates are going? Check out our thoughts below!

High End Opportunities

Low Inventory. How often have you heard that mentioned in the media, or by me on my blog!? We are at historic lows for both interest rates and available housing inventory. But, there are some opportunities for those buyers looking to sell their homes and purchase something more expensive. If you are looking to downsize or purchase a home with a more reasonable payment there are absolutely ways to do that as well and we can have that discussion next week!

Whether you are having more kids, got a promotion, or just need more space for the dog, there are a lot of opportunities for buyers looking to upgrade their home. As we know, homes are selling quickly in the Northern Colorado area. We have a shortage of new homes (I have two available right now HERE and HERE if you would like to take a look!), and a lot of buyers looking to take advantage of the amazingly low interest rates. But, as you get in to the higher price ranges, there are fewer buyers, and homes aren't receiving multiple offers as often which makes it a little bit less stressed of a marketplace.

Check out the info below that shows all of Fort Collins' price ranges. We are still hovering around a month worth of inventory (SUPER low when a balanced market is defined by the National Association of REALTORS at 6 months of inventory).

But, if you look at the info below, we are at almost 6 months worth of inventory for homes over $750,000. So that beautiful remodel in Old Town or newer construction on the southeast side of Fort Collins will be easier to attain than fighting over a $400,000 in the middle of town.

If you have considered the possibility of selling, or just want to talk real estate or grab coffee give me a call and I'd love to meet up! Have a fantastic week!

The Sky ISN’T Falling! Fed Rate Hike Discussion

Federal Reserve Building, Washington DC, USA

I hope you are all ready for Christmas time, it is getting here too quickly!

I want to direct you to an article that was brought to my attention yesterday that outlines the reasons that the change in the Federal Reserve's long standing position of no rate increases won't necessarily mean a direct correlation to an increase in interest rates for homes. It has to do mainly with the fact that interest rates are affected more by the bond/fixed securities market, which is not expected to change much just yet.

CHECK THE ARTICLE OUT HERE, and please feel free to give me a call or shoot me an email with any questions!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link

2019 Economic and Housing Forecast

2019 Economic and Housing Forecast