Two Story Town-home with Mountain Views in Fort Collins!

Updated 3 bedroom, 3 bathroom at 2502 Timberwood Dr #82 in southeast Fort Collins town-home! Close to sought after schools, easy access to I-25, restaurants and shopping. Vaulted 2 story ceilings in the living room and an open floor plan. Relax on the back patio that opens to the greenbelt. New flooring, new paint, and stainless appliances. Finished basement creates a second en-suite area! Call for your private showing at 970-673-7285 for more information or click the link below for more details.

Friday Fun Facts!

|

|

|

|

|

|

Friday Fun Facts – 66% Off!

This just in…

For the month of April, the average price of a home in the city of Boulder was $1,247,000. This is according to the latest from our IRES MLS system.

If you want to own a home about an hour down the road in another really nice college town and get a 66% discount, you may want to check out Fort Collins 🙂

Yes, despite the recent uptick in prices here locally, we are still a bargain compared to Boulder. Here are median single-family prices for our markets and their relative price to Boulder:

- Fort Collins = $414,237 (66.8% off)

- Loveland = $360,150 (71.1% off)

- Greeley = $290,000 (76.7% off)

- Windsor = $306,450 (75.4% off)

Grab a copy of my Investment Kit so you can see the simple steps to get started without stress or complication. Email me at phunter@windermere.com and I will send you a video which clarifies the process and my Investment Checklist so you can see what to do first.

The Historic James B. Arthur Home is For Sale!

334 E Mulberry St a prime Old Town Fort Collins location. Close to restaurants, bars, galleries, festivals, and more. Private parking lot with 21 spaces. Building built by a pioneer in the brick and plaster businesses. The Arthur House was a single family home for Colorado pioneer (and others), fraternity house, full-time assisted senior living. Has a CO for 5 apartments. Zoned NCB, this property could remain apartments or adaptable to numerous businesses or a residence. Contact me for your private showing at 970-673-7285 or click the link below for more details.

Quaint Home with Amazing Landscaping!

BEAUTIFULLY maintained home at 2509 Tulane Dr, just a block from O’Dea Elementary. Permitted addition makes this home almost 2,400 square feet. Wood floors on the main floor in fantastic condition, open kitchen to the living room. Newer style vinyl windows throughout, new roof in 2015, new carpet in most rooms, and a brand new furnace! Landscaping is as close to perfect as it can get. Large office, study and recreation room with its own access to the backyard. An amazing opportunity under $400,000 in South College Heights! Call for a private showing or click the link below for more details.

http://windermerenoco.com/listing/77000317

The Scoop! Is Here

Are We Bubbly?

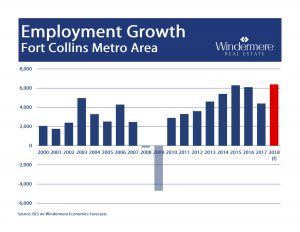

Because our Northern Colorado market has been so active over the last four years, clients often ask me if wIe think there is a housing bubble forming.

There are several key statistics which we track closely in order to answer that question.

Here is one fact that we find to be insightful…

One of the root causes of the last housing bubble was the glut of inventory, and specifically new home inventory. Quite simply, the market was being oversupplied with new homes. The rules of economics say when there is oversupply, prices must come down.

Today, there are far fewer new home starts compared to 2004 and 2005 when the last bubble was forming – despite there being a larger population.

According to our friends at Metrostudy who track the new home market, Northern Colorado has had 4,452 new home starts in the last 12 months.

That number is only 60% of what it was at the height of construction in early 2005.

It is also interesting to note that over the last 12 months there have been 4,473 new home closings which shows that demand is keeping up with supply.

So when you drive around Northern Colorado and notice all the new homes being built, know that construction activity is far less than what is was during the bubble and that demand is keeping up with supply.

In case you missed our annual real estate Forecast event, you can reach out to me to see the presentation slides or receive a video recap of the information. Just email me at phunter@windermere.com

Windermere Market Forecast

I want to thank everyone that was able to make it to our Market Forecast last week, we all really appreciate it! If you would like to get the powerpoint presentation or would like a rundown from the event, please give me a call or shoot me an email. Or if you would like to know more about the market activity in your neighborhood or the value of your home specifically, let me buy you lunch and we can talk more about it!

Friday Fun Facts!

|

|

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link