WELCOME TO “THE SCOOP”

Everything You Need to Know About the Northern Colorado Real Estate Market – Produced Quarterly by Windermere Real Estate in Northern Colorado

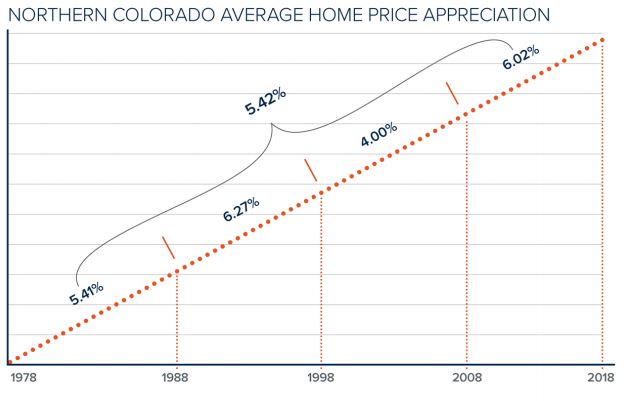

The 10-Year Rhythm

As we study 40 years of price appreciation data for Larimer County, an interesting pattern emerges. We call this pattern the 10-Year Rhythm. It shows that price appreciation in ten-year segments tends to closely mirror the 40-year average of 5.42%. This demonstrates that our market grows in a steady, predictable way instead of taking wild swings like other markets.

Long Term Home Prices

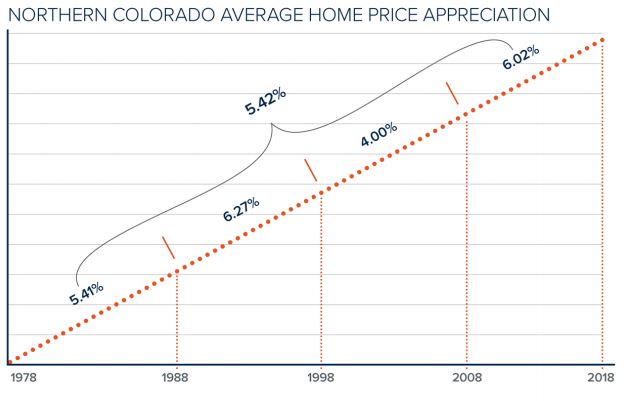

A trusted resource is the Federal Housing Finance Authority (FHFA) which tracks nearly 300 markets across the country and produces a quarterly price appreciation index.

Larimer County

Weld County

State Ranking

According to the Federal Housing Finance Authority, these are the top 5 states for home price appreciation over the last 5 years:

A Mile High

Did you know our state grows by a Mile-High Stadium’s-worth of people each year? That’s right, we’ve been growing by about 75,000 people each year, and we will keep growing. The State Demography office estimates we will have 7.5 million people living here by 2040.

Market Speedometer

Each quarter. our Chief Economist Matthew Gardner produces his economic report for Metro Denver and Northern Colorado. Inside you will find his market speedometer. This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

According to Gardner, “I have moved the needle very slightly towards buyers as a few Front Range counties saw home inventories rise. However, while I expect to see listings increase in the coming months, for now, the housing market continues to heavily favor sellers.”

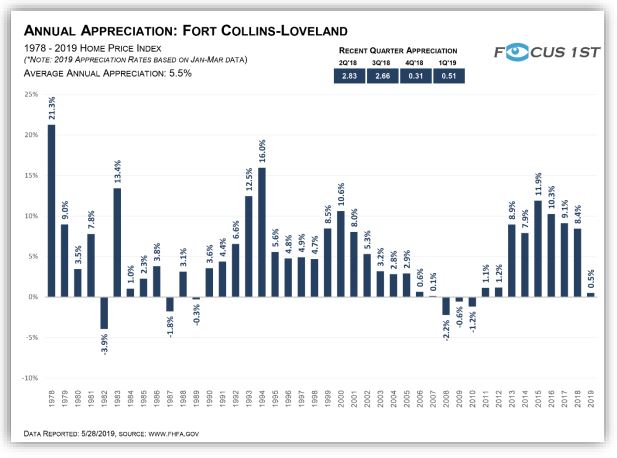

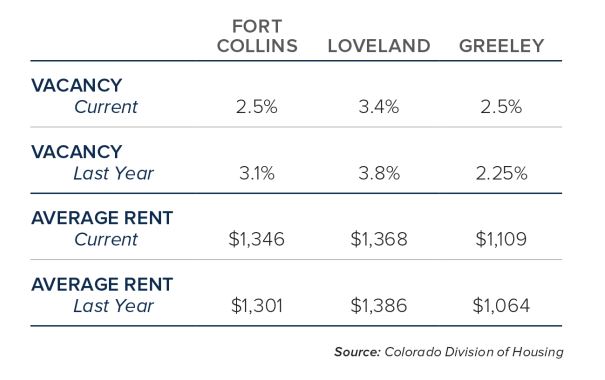

Rental Numbers

What’s Up With Down Rates

It was only a few months ago when experts predicted that 30-year mortgage rates would hit five percent by the end of 2019. For many, it was a foregone conclusion. At the end of 2018, they were already in the high fours. It appeared as if the low interest rate party was over. Then along came mid-2019 and rates kept going lower and lower. Now they are in the high threes and back to where they were in the fall of 2016. What gives? It turns out that trade tensions between the

U.S. and China have caused concerns about a global economic slowdown which, in turn, have pushed rates lower. Lower rates are of course great news for buyers and people thinking about refinancing.

A Unique Solution

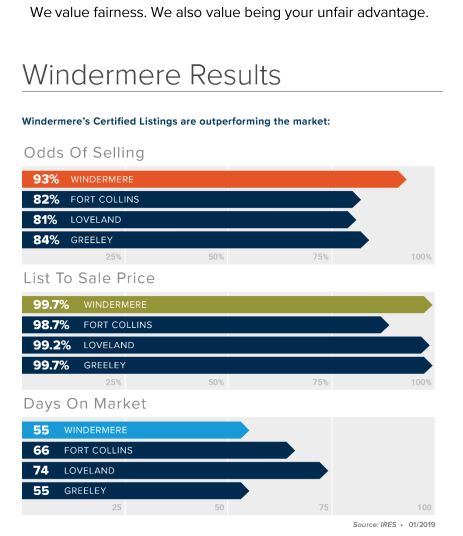

Windermere Listings

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link